- Em que podemos lhe ajudar?

- 21 2240-0232

- 21 99624-5304

- [email protected]

A no cash down home loan is also called 100% financial support

USDA Finance in the Kentucky Rural A home loan Selection

Dezembro 14, 2024Yieldstreet is not an excellent fiduciary of the advantage of every individuals have fun with from otherwise entry to which device

Dezembro 14, 2024A no cash down home loan is also called 100% financial support

The idea of purchasing your house with no cash down was tempting. But it is more difficult accomplish today than just it was ages in the past.

Such fund need no deposit purchasing property. For those who lack numerous discounts, it will help being not have a lower payment whenever providing home financing.

However it is loan places Silverthorne harder to acquire zero down mortgage loans now for everybody customers, especially those having poor credit. People that do not have good credit can always rating a financial, for example through the FHA, however you will still have to developed good step three.5% deposit.

Some applications of the Federal national mortgage association and you can Freddie Mac computer together with could possibly get ensure it is you to receive a house which have poor credit but you will still have to generate good step 3% down payment.

For the a property increase off several years back, 100% funding mortgage loans was simple to track down even although you had poor credit. Consumers who had nothing dollars, less than perfect credit and erratic operate nevertheless gets a house that have nothing currency off. It was in addition to you’ll locate financing that have limited documents in which income and you will obligations weren’t revealed.

Now, it is much harder for people with bad credit and more than others to track down a great 100% resource loan. The following is as to why:

It owed more about this new belongings than these people were value. These were unable to sell your house because it wouldn’t pay off the borrowed funds. Because cost savings tanked, some one missing its jobs and may also perhaps not maintain the payments.

After this financial emergency, the government moved for the. It caused it to be much harder for all of us to qualify for mortgage brokers by passing this new Dodd Honest Work. Now, loan providers must totally file this new borrower’s income and show it did the due diligence to be sure brand new debtor can be afford the mortgage.

100% Financing Software Ran Out for those who have Lowest Credit ratings

After such as a primary monetary catastrophe, they turned into clear into the You regulators one to 100% investment no downpayment home loans are often also high-risk. Those who don’t possess an advance payment and also have average otherwise less than perfect credit don’t have a lot of risk yourself. When things start to change south economically, the majority of people walk away throughout the domestic. Which taken place in order to many Americans within the freeze and it also assisted to help you container the usa benefit.

There are a few choices today. Today, there’s two significant 100% funding home loan apps offered that are backed by the usa government. Some individuals which have mediocre so you can less than perfect credit could possibly be considered.

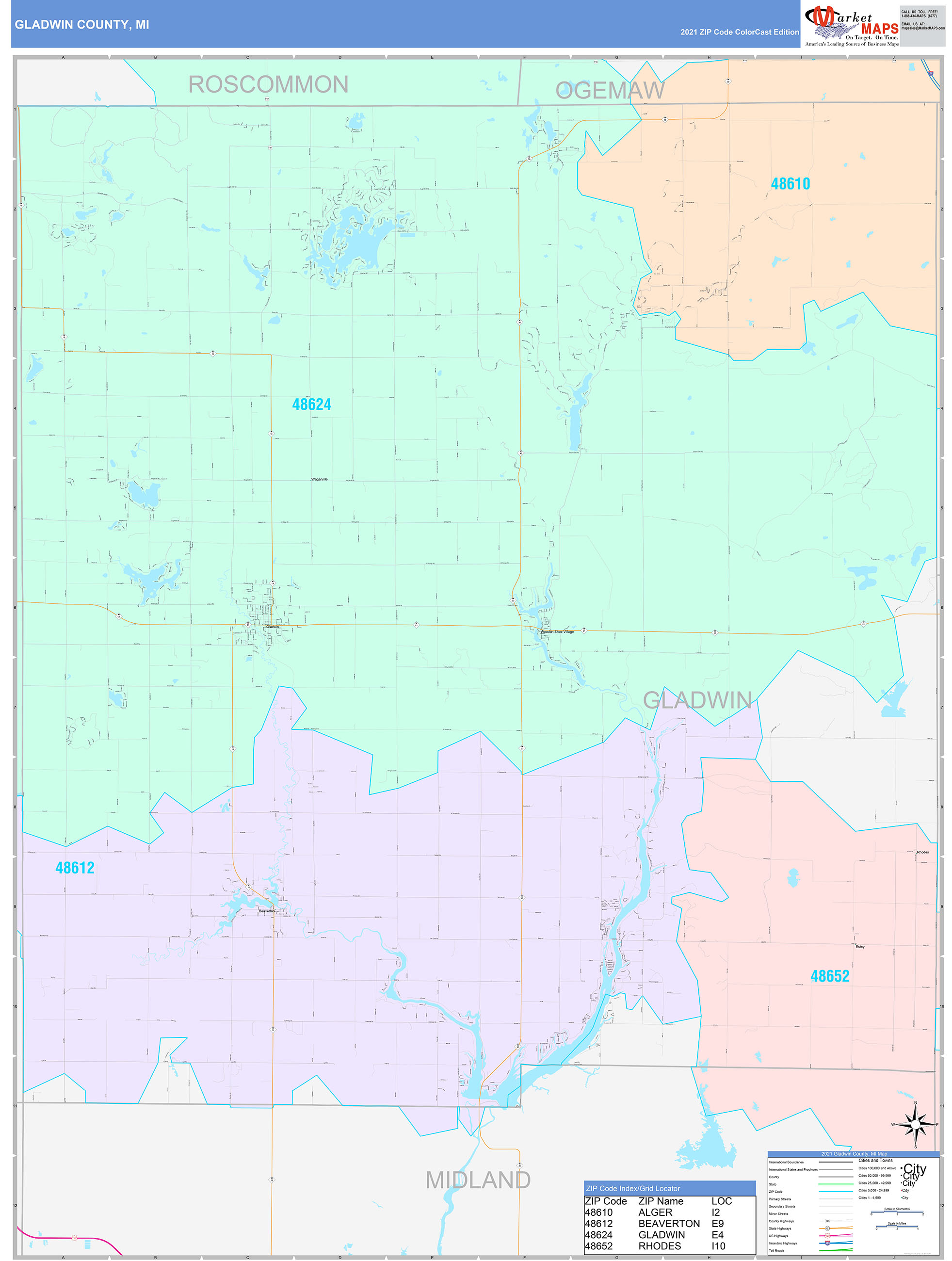

The foremost is the fresh USDA financing system. If you’re to get property within the a rural urban area, you may be capable of getting a no down payment house loan. Attempt to possess an excellent 620 otherwise 640 credit history, and you’ve got to display you could spend the money for loan along with your economic documents. You can find earnings restrictions about this USDA finance; you do not be considered if your income is actually higher.

In the economic crash, of a lot consumers which have less than perfect credit that has set no money down receive these people were under water because their home values fell

One other choice is new Va home loan program. This can be a great 100% financial support system that is available to pros and you can active army. Surprisingly, in many cases you might have poor credit nonetheless get approved for this no advance payment mortgage program. When to possess no down loan providers do not forget to enquire about down commission advice programs