- Em que podemos lhe ajudar?

- 21 2240-0232

- 21 99624-5304

- [email protected]

Another significant grounds to consider when comparing medical practitioner mortgage loans so you’re able to antique loans ‘s the underwriting processes

Mr Bet Provision 10 Eur ohne Einzahlung & Promo Codes 2022

Outubro 20, 2024An informed Online casinos the real deal Money in Oct 2024

Outubro 20, 2024Another significant grounds to consider when comparing medical practitioner mortgage loans so you’re able to antique loans ‘s the underwriting processes

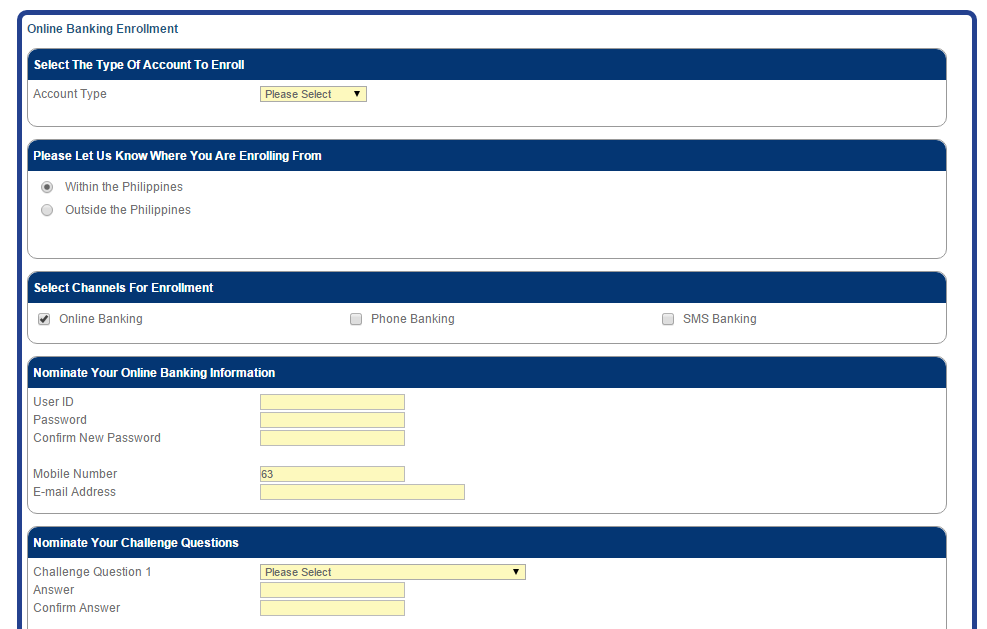

Underwriting Process Distinctions

Doctor mortgage loans essentially make it easier to be considered than the other lenders. They often deal with a finalized employment contract as proof of income unlike demanding https://availableloan.net/installment-loans-ks/ shell out stubs otherwise taxation statements. So it smooth process can save time and clarify the loan app techniques to own doctors.

In contrast, antique loans typically have stricter underwriting criteria. Loan providers could possibly get consult thorough files, plus pay stubs, tax returns, or other financial suggestions. While this comprehensive review processes ensures the fresh new lender’s rely on regarding the borrower’s capability to pay off the borrowed funds, it can be longer-ingesting and you may potentially perspective demands to possess medical professionals having non-traditional work plans.

Knowing the variations in brand new underwriting processes can help physicians dictate hence loan solution aligns greatest along with their financial predicament and you can saves them time and effort in software process.

Evaluating physician mortgages so you’re able to antique finance lets doctors to help you weigh the brand new benefits and drawbacks of each choice. When you’re physician mortgage loans bring positives such freedom inside the deposit standards and you will simple certification, it is vital to carefully think about the potential downsides, plus higher rates and you may long-name economic effects. By very carefully evaluating the features, costs, and you will underwriting procedure, physicians helps make the best choice that meets their situations and you may financial requirements.

Disadvantages and you will Factors

With regards to medical practitioner mortgages, you will need to know the prospective cons and you can factors from the this type of financing. Knowing the dangers and you may weighing all of them against the gurus is important for making the best decision.

Risks of Physician Mortgage loans

When you’re medical practitioner mortgage loans bring particular benefits, you’ll find dangers one to individuals are going to be wary of. Some prospective cons are:

- Becoming Family-Poor: Physician mortgages may meet the requirements borrowers to have a home loan founded into personal debt-to-earnings rates one to exit little room to many other expenditures. This can lead to the right position where a critical percentage of earnings goes toward mortgage payments, making limited loans some other very important will set you back such insurance, taxes, repair, and solutions.

- Zero Security: Doc mortgage loans usually enable it to be consumers to shop for a home with zero guarantee or downpayment. Although this may seem attractive, in addition carries the risk of motion from inside the casing pricing. In the event that houses prices decline when you’re carrying a health care provider mortgage loan, consumers may potentially deal with economic pressures .

- Exception away from College loans: Medical practitioner mortgage loans generally speaking ban idea away from college loans for the underwriting procedure. While this is going to be advantageous to own financial approval, it could bring about significant expenses associated with college loans. Its crucial for borrowers to carefully envision the student loan fees bundle prior to investing home financing.

- Alternative Alternatives: When you’re medical practitioner mortgage loans get allow consumers to cease using individual mortgage insurance rates (PMI) despite beginning with zero equity, you should explore most of the alternatives just before continuing on the mortgage. There could be down interest rate possibilities that may promote greatest enough time-label financial masters .

Varying vs. Fixed Pricing

A unique idea in terms of physician mortgage loans ‘s the possibilities between variable and you will fixed rates of interest. Here’s a brief history of each and every:

- Adjustable Speed: Having a changeable-rates home loan (ARM), the rate is generally fixed having a first several months, then adjusts periodically predicated on market standards. When you are Fingers may offer lower first rates of interest, it carry the possibility of costs broadening through the years, possibly leading to higher monthly payments.

- Repaired Rate: Having said that, a predetermined-rates mortgage holds a similar interest rate about financing label. Thus giving balance and you may predictability, due to the fact consumers know precisely what the monthly payments was. However, fixed-price mortgage loans will feature quite higher 1st interest rates opposed to Fingers.