- Em que podemos lhe ajudar?

- 21 2240-0232

- 21 99624-5304

- [email protected]

Cellular Take a look at Put Faqs: Restrictions, Fees, How much time it needs wild life online slot & A lot more

Immortal Romance Remastered Microgaming Slot Comment

Outubro 14, 2024Bar Club Black colored Sheep Position 100 percent free Trial & Games Remark Oct 2024

Outubro 14, 2024Cellular Take a look at Put Faqs: Restrictions, Fees, How much time it needs wild life online slot & A lot more

We don’t very own or control the items, characteristics otherwise articles found there. When the here isn’t a department otherwise Atm close by, you could potentially deposit your own look at because of the mailing they to help you you which have a deposit slip. If you wear’t features a deposit sneak, you can just create your bank account amount for the consider. To make certain there are no bugs with your mobile put, get photographs of your own sign in a proper-lighted urban area as well as on a flat surface one to’s clear and you may black. Make sure the newest take a look at try totally in the frame you to definitely you find and therefore hardly anything else is seen.

Wild life online slot: How much time do i need to hold my personal brand new look at? What the results are easily throw away the new consider and you can an issue appears?

This site is generally compensated through the lender marketer Affiliate Program. Really banks put aside the ability to alter this type of restrictions to have almost any cause. The standards range from account ages, relationships condition, activity, and membership stability. Contain otherwise improve your direct put information to possess Va handicap compensation, your retirement benefits, or knowledge benefits on the web. Direct Bill allows you to discovered calls of incarcerated anyone and you will feel the phone call costs recharged straight to your monthly.

Do a free account

“Chase Personal Client” ‘s the brand name for a financial and you can money device and you may solution offering, requiring a great Chase Individual Consumer Examining℠ account. A number of the brand new applications nowadays run-in video clips setting and you will snap the picture to you personally when conditions are right. Bank of The usa, You.S. Financial and you can Wells Fargo are among the huge financial institutions utilizing the brand new tech. The new software encourages your if or not you will want to, say, go on to the best, rating nearer to the fresh look at or have fun with far more light. Hold the check in a rut before money has removed on your own account.

If your paycheck arrives connected with a complete piece of paper with a wages stub, “split all that out of making it a good rectangle,” Helcl states. Nothing is going to be attached, and people take a look at stubs, spend glides or discount coupons. Of many, otherwise all the, of the points appeared in this post are from all of our advertising people just who make up united states when you take certain tips to the our very own web site or click when deciding to take a hobby on their site. Here’s a listing of the lovers and here is how we profit. We think folks will be able to make monetary choices having confidence.

Cellular put, labeled as cellular take a look at put, is actually an electronic treatment for put paper inspections into the examining or bank account utilizing your mobile phone or any other mobile device, such a supplement. It’s a secure and you may safe way to put a check rather than being forced to trek to your regional lender department or Automatic teller machine. As well as, you should use cellular deposit 24/7 at any place you’ve got cellphone solution otherwise Wifi—though it’s better to avoid on the web banking to your a community Wi-fi circle to help keep your advice safer.

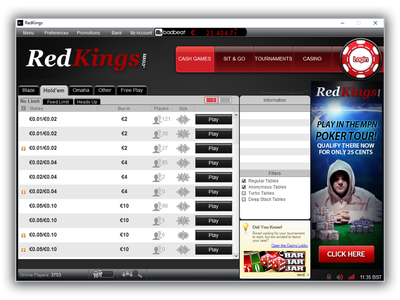

Band of Games

Access your finances just as fast(or smaller) than a teller put. “A light check up on a white dining table is very difficult for the system observe,” Helcl states. Hectic designs — even the speckly grain away from a granite cooking area table — build a bad history to have a check photographs. You to rejected be sure Helcl tested ended up being snap “at the top of a synthetic bag out of peanuts that has been for the a Batman printing tablecloth,” he says. All the reflections and you can bases made for a poor photos and you can an unsuccessful deposit.

- If you plan to utilize a cover by the cell phone programs such Boku otherwise Zimpler, you’ll you desire a smartphone capable of getting the fresh software.

- With the system, relatives and buddies is quickly create bail repayments because of the mobile phone or from the business.

- There is a regular limitation from $5,100000 total inside checks, when you try to put more than $5,one hundred thousand, you’re going to get a message you to definitely states, “Business day amount limitation surpassed.”

Should your photographs isn’t really the right, the fresh software won’t make sure whether or not the look at is legitimate plus the consider can’t be affirmed. Should your look at might be recorded, the wild life online slot newest app will usually give recommendations for enhancing the photographs quality and enable numerous retakes. Creditors benefit by simply making fewer travel to help you ATMs to select right up physical checks and you will drawing people who is generally beyond its instantaneous geographic town. You’re going to get a direct email address alerts confirming you to we have obtained your own deposit and something whenever we now have recognized it to possess processing.

What exactly is Mobile Put?

Cellular put enables you to quickly, easily, and you will safely put a check on your bank account instead going to a part otherwise Automatic teller machine. To ensure the method goes smoothly, stick to the proper actions, including safely promoting the fresh look at and you will getting clear pictures from they. You’ll be given the possibility to select and this membership are certain to get the new put, such as your checking otherwise savings account. You may make as numerous deposits as you wish, but you will find daily and you will month-to-month restrictions for the money matter you can deposit. When you attend get into their take a look at, the new app can tell you the maximum amount you can deposit.

Whenever we get back a product for your requirements unpaid for any reason (such as, while the commission are avoided or there had been shortage of money to pay it) you consent never to redeposit you to Goods via the Service. Your commit to maintain the Item inside a safe and you can safer environment for starters day regarding the go out of put acknowledgement (“Preservation Period”). Abreast of demand away from Bank or Merrill, you will promptly deliver the Goods in order to Lender otherwise Merrill throughout the the new Retention Several months. After the new Maintenance Several months, your commit to damage the item within the a safe manner. Returned Things.You’re solely responsible for any item for which you features already been provided provisional credit, and you may any such Goods that is returned or refused is generally billed for your requirements. You recognize that all credit obtained for deposits generated from the Services are provisional, at the mercy of verification and you will last payment.

This can be a conclusion particular sports gamblers you will avoid spend from the mobile gambling. Which have two various methods to possess deposit and you may detachment will be hard because’s maybe not a smooth process. Whilst it will be a terrific way to put bets having fun with your mobile phone, spend from the cellular usually isn’t welcome as the a withdrawal means. It means you need a different option when deciding to take their money from the account. Utilizing your cellular telephone statement entails the brand new commission will be generated later.

You can check the newest words or contact customer support to confirm you should use the telephone expenses put method to allege a keen provide. Find a very good mobile phone expenses playing sites and figure out and therefore one to you want to register for. You will need to type in your own personal information such as identity, target, birthday celebration, and.

For many who currently have one to, find out how to alter your direct put information. Joining automated alerts have a tendency to notify you whenever an immediate put is available in your bank account. Favor the way you should discover notice — email, text, otherwise push notice to your cell phone. It also also offers a just how-to movies that presents you the way to utilize the brand new mobile view put ability.

- You’ll be asked to pursue certain certain prompts doing the exchange, prior to confirming it.

- FanDuel has grown inside dominance having choices for instance the exact same-games parlay and you may a $step one,100 Zero Sweating bet.

- Thankfully, you could manage on your own against this form of mobile deposit view scam because of the only accepting report inspections from anyone you are aware and you may trust.

- You’ll get quick confirmation your deposit is actually acquired.

- When the a photograph out of something has been transmitted so you can you or even to all other lender, you would not let the Goods getting next displayed because of the some other mode.

Paze causes it to be fast and easy and see on line rather than revealing their actual credit amounts. Bail money is actually processed by the TouchPay Holdings, LLC dba GTL Financial Services, an authorized Money Sender, and susceptible to TouchPay’s Terms of use and Privacy. The brand new Inmate Bundle Program is offered every six months while the a great treatment for buy a meal/health plan to have incarcerated family members otherwise members of the family. ADC establishes a dollar restrict for bundles purchased during the designated program episodes (constantly anywhere between $100-$150).