- Em que podemos lhe ajudar?

- 21 2240-0232

- 21 99624-5304

- [email protected]

Exactly why do Loan providers Require a home Examination Statement Just before Loan Acceptance?

Ozwin Casino 25 No Down Payment Free Of Charge Spins Reward Code About Vegas Xl January 2024

Novembro 28, 2024The money create are going to be invested in senior years income otherwise utilized having home improvements, vacations or any other privileges

Novembro 28, 2024Exactly why do Loan providers Require a home Examination Statement Just before Loan Acceptance?

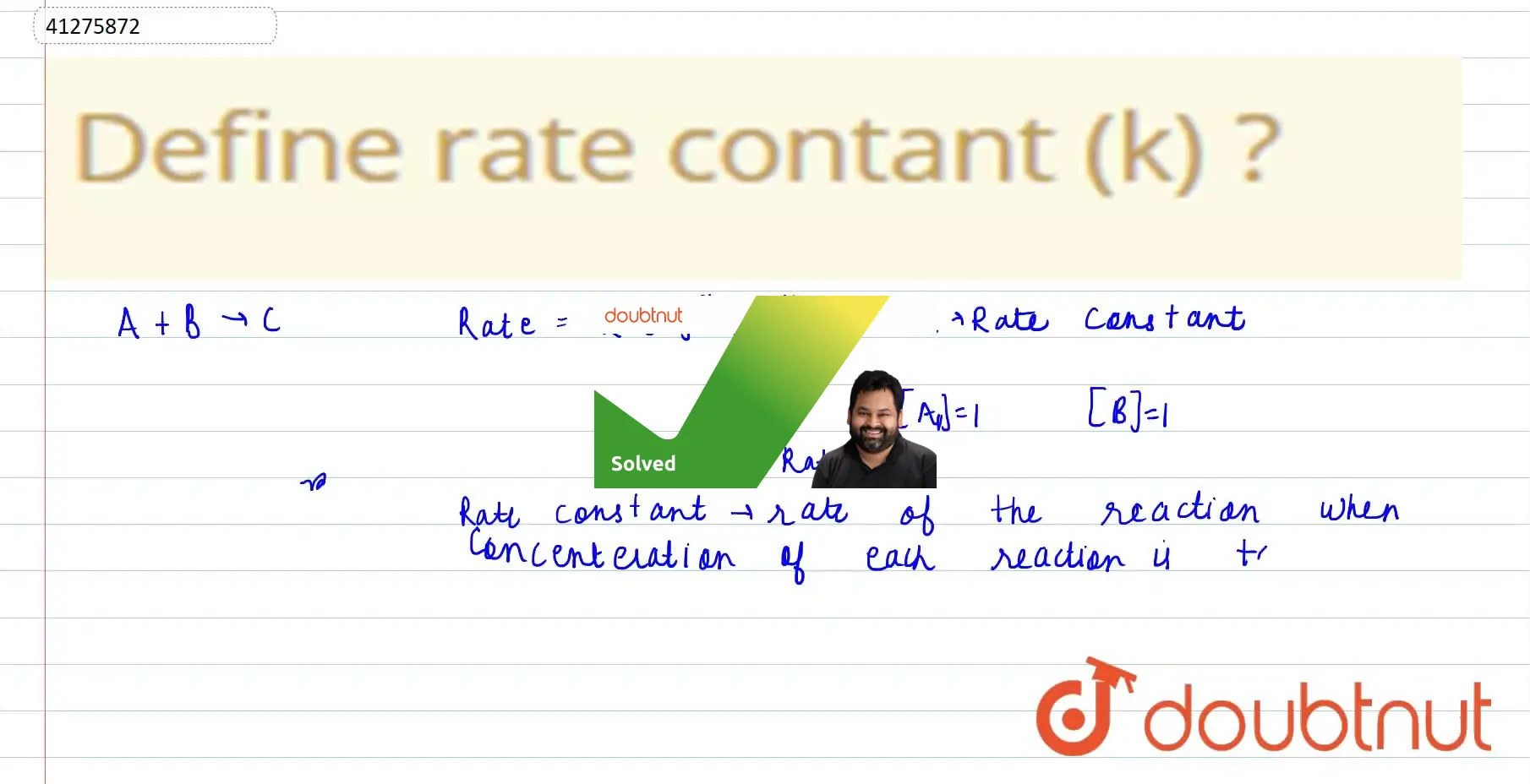

Always, once you pick a house, you make an application for a mortgage loan. But, to obtain the recognition, you will find some standards you need to see. One requisite is actually a comprehensive family review report.

Bringing a home evaluation report serves as a safety scale getting you and the financial institution. That have a report at hand, you earn detail by detail skills on property’s condition, showing the potential facts otherwise problems that may apply at their worthy of otherwise security. By the understanding the true updates of the home, lenders can also be measure the number of exposure associated with mortgage. This will help them generate advised decisions out-of approval and you can terms.

Within this writings, we are going to talk about some other things that identify as to why loan providers require a beneficial home evaluation report before loan recognition. So, instead of subsequent ado, let us initiate…

Evaluate Property Standing

Evaluating new property’s standing is a vital step-in your house examination , thereby its toward loan providers. This new thorough study of the new expertise, architectural ethics, as well as the tall things from the assets lets loan providers determine whether credit currency could be worthwhile.

- Foundation

- Rooftop

- Plumbing

- Electrical assistance

A completely independent analysis might possibly be documented on the examination are accountable to assist lenders determine the amount of exposure associated with loan. On the other hand, they lets them build advised decisions of loan acceptance and you may expose compatible terms which can line-up into the property’s reputation.

Determine Exposure Top

Credit money do cover risk, however, just at the what height? Some tips about what a home review statement breaks out over a good bank. Essentially, a loan provider is wanting to determine exactly how secure its to help you give money to help you a person who was to get property. They do this by carefully looking at the new evaluation declare that shows the fresh new property’s true position.

For example, in the event the house suggests a number of activities or needs a beneficial bunch of solutions, you to sooner makes it riskier to the lender. Simply because there was a top opportunity you to things you will get wrong subsequently. While doing so, whether your residence is in greatest condition and you will doesn’t require much fixes, then it’s less risky.

Thus, by the examining the risk top, loan providers renders smart conclusion on whether or not they is approve the latest mortgage and, if yes, what conditions they need to set. Generally, it is on the ensuring there is not continuously chance associated toward financial support.

Manage Money

Whenever you are to find property, and the lenders is actually investing their funds, protecting the capital is but one major concern in their mind. Referring to why lenders require property examination report.

Securing the latest money is actually a primary matter for loan providers whether or not it pertains to requiring a house review statement. Envision you secured your financial budget to buy a present, like a rare trading credit. You’d want to make sure they lives loans Woodland Park CO in good shape, correct? Well, to have loan providers, offering a loan feels as though investing their cash inside the people else’s property. They wish to make certain resource is secure and will not treat worth out of the blue.

Through getting a property assessment report just before mortgage recognition, loan providers may to learn about one hidden activities or possible issues with the home. This lets all of them generate told choices in regards to the financing. Eventually, protecting its financial support means shielding its financial welfare and you will making certain that the house remains an asset. Just like might want to manage your own valued exchange credit, lenders want to protect their cash.

Make sure Borrower’s Monetary Really-Getting

When lending a loan, an aspect that a lender assures will be your monetary really-becoming, as well as wanted a house assessment report.

Loan providers usually should make sure that you are not trying out far more economic exposure than just they’re able to manage. With an intensive house review, lenders normally select any potential issues that you are going to apply to your bank account later on. Such as for instance, high priced repairs often affect their pockets big-time, so you might be unable to generate mortgage payments or find yourself purchasing property that may not be beneficial. Thus, guaranteeing the newest borrower’s economic well-being setting creating in control credit practices and you can allowing them to generate told decisions about their coming.

Assists Informed Behavior

Assisting informed decisions is a vital aspect of the household check procedure for loan providers. They have to enjoy smart when giving financing, as way i would towards the every single day products that we purchase, taking a look at the critiques, evaluating cost, and you will thinking about most other experts. Loan providers should also perform some same and you will go through a great somewhat similar process. By the carefully examining the house examination declaration therefore the inspection’s conclusions, they rating beneficial understanding on property. It understand the potential risks involved, this new property’s selling worthy of, any big otherwise slight circumstances, etc. This lets them create really-told choices on whether to accept the mortgage and decide for the this new terms and conditions they’ll be providing.

Let-alone, facilitating informed choices about credit processes ensures a flaccid and effective household-to get techniques to you personally therefore the lender.

Conclusion

Home review just before mortgage approval is an important step for lenders because it functions as an excellent safeguarding level during the a home deals. With this thorough process, lenders is precisely measure the relevant threats, protecting their money and you may making sure the fresh new borrower’s monetary better-becoming.

By securely knowing the examination report, lenders can make advised conclusion where they may be able lay compatible terminology and standards for financing approval. This will act as a collective effort amongst the bank and you can the fresh new debtor. The latest review statement commonly build visibility and you will diligence between each party. In the course of time, which fostered a fair lending techniques and a profitable homeownership.

Sense peace of mind that have Professional Inspections! Whether you are purchasing, offering, or looking after your household, our very own thorough inspections give you the studies you really need to make told choices. Agenda your review now and ensure your house capital is actually secure for many years.