- Em que podemos lhe ajudar?

- 21 2240-0232

- 21 99624-5304

- [email protected]

FHA Financial Costs by the Credit score: 620, 700, 580, 640

Best PaysafeCard Local casino Sites with Lowest Deposit 2024

Outubro 27, 2024Dish Casino No-deposit Bonus: 50 100 percent 30 free spins dragons pearl free Revolves

Outubro 27, 2024FHA Financial Costs by the Credit score: 620, 700, 580, 640

FHA home loan cost are usually greater than conventional mortgage costs, nonetheless will likely be a good idea for borrowers which have lower fico scores otherwise reduced off payments. Minimal credit history having a keen FHA financing is actually 580 having an excellent step 3.5% deposit, otherwise 500 that have good 10% advance payment. However, of numerous FHA loan providers need credit scores with a minimum of 620.

FHA home loan costs avoid using exposure-mainly based costs models, so might there be zero extra charges or superior having all the way down credit results. But not, your credit rating can still affect the interest rate. Consumers that have large fico scores will normally qualify for lower attract pricing.

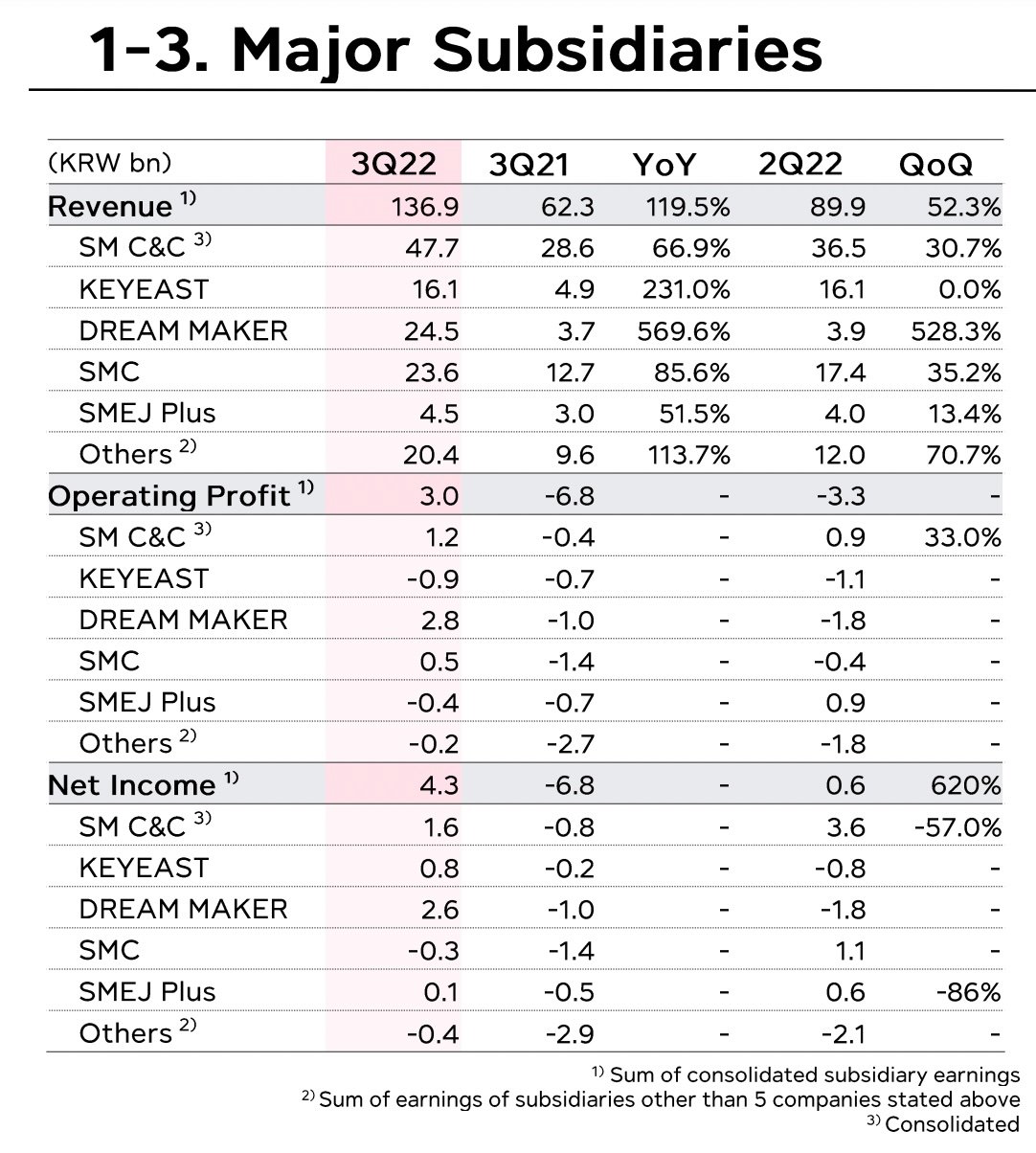

Average FHA Interest Alterations from the Credit score

The average FHA mortgage debtor has actually good 674 FICO rating and a good six.41% rate of interest. Borrowers with credit scores away from 760 or maybe more fundamentally score recharged a low rates.

FHA Pricing to own 580 Credit history

Minimal credit rating to have a keen FHA loan try 580 which have a step 3.5% deposit. However, many FHA loan providers need fico scores with a minimum of 620. Whenever you make an advance payment of at least ten%, you could potentially qualify for an FHA loan that have a credit rating only 500.

FHA Cost to own 620 Credit score

FHA home loan prices are not privately associated with your credit score. not, a credit rating off 620 you certainly will be considered you to own an enthusiastic FHA loan that have a rate regarding cuatro.125%. It is a great 0.75% miss out-of a get from 610, that may save you more $forty,000 for the interest repayments toward a beneficial $250,000 family. FHA mortgage individuals which have a credit score off 620 or maybe more you will be eligible for downpayment choice doing from the 3.5%. Borrowers with a score regarding 500-610 diversity usually qualify for deposit possibilities performing during the ten%.

FHA Pricing to own 680 Credit history

A credit history of at least 680 is known as good. As a result you are a relatively reasonable-exposure borrower and generally are gonna be eligible for competitive interest rates to the funds.

According to Bankrate, an average FHA mortgage rates to possess credit scores off 680-699 try 5.531% since . But not, it is essential to note that interest levels can differ built towards enough things, including the amount borrowed, financing label, while the borrower’s personal debt-to-earnings proportion.

Individuals that have a credit score regarding 680 and you can a deposit of at least 3.5% normally qualify for a keen FHA financing. FHA fund supply all the way down mortgage insurance premiums than simply traditional funds, that can save your self consumers money along side life of the borrowed funds.

FHA Costs getting 700 Credit score

The newest national average 29-12 months FHA home loan rate of interest is 6.85%. The average FHA 203(b) loan speed are step three.28%. As of middle-, good 700 credit rating you certainly will secure mortgage loan out of six.796% having a 30-seasons fixed-price mortgage loan out-of $3 hundred,000.

When you yourself have a lowered credit history, there are lots of steps you can take adjust their chances of qualifying for a keen FHA loan which have an aggressive attention rate:

- Look around and you can evaluate has the benefit of of multiple loan providers.

- Rating pre-recognized to have a mortgage in advance selecting a house. This may make you an idea of how much you can borrow and you can exacltly what the monthly obligations would-be.

- Create more substantial down-payment. This will slow down the amount of cash you really need to use and also make your a quicker risky borrower so you can lenders.

- Envision bringing a great cosigner. Good cosigner was someone with good credit whom believes are guilty of your loan for folks who standard.

If you’re considering an FHA mortgage, it is very important research thoroughly and you may understand the requirements and you will interest rates. Because of the facts the options, you can make a knowledgeable choice for your financial situation.