- Em que podemos lhe ajudar?

- 21 2240-0232

- 21 99624-5304

- [email protected]

How much security would you like having a beneficial HELOC?

Free Casino best big time gaming games Bonuses: No-Deposit, Totally free Spins or any other Now offers

Novembro 18, 2024Mega Moolah Gambling establishment No-deposit Totally free Spins Bonus mystique grove online slot Requirements

Novembro 18, 2024How much security would you like having a beneficial HELOC?

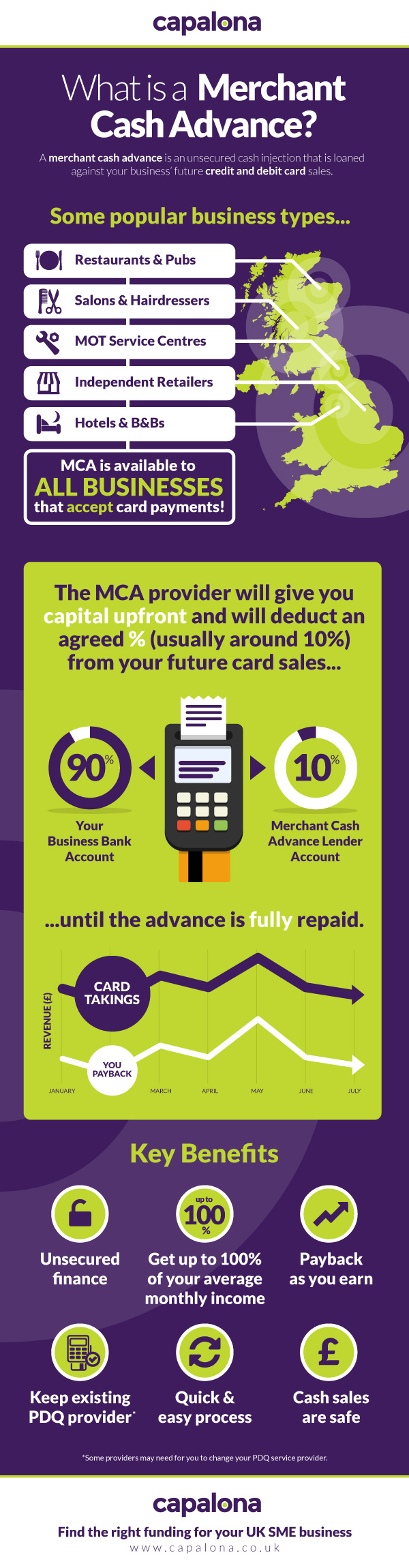

The newest collateral you would like getting a home equity credit line (HELOC) relies on the financial institution as well as the particular loan terminology.

A great HELOC mortgage allows borrowers to make use of their home guarantee due to the fact equity, such property guarantee mortgage. Good HELOC functions much like credit cards – immediately after acknowledged into the line of credit, you can borrow as much as the quantity readily available and employ it to possess any sort of goal you consider required. Anybody will use a HELOC when they need access to high amounts of currency and make home improvements or to pay back personal debt.

But collateral requirements is more nuanced than a strong payment since loan providers plus grab other factors into account.

What you should know about household collateral to own a good HELOC

- The mortgage-to-really worth ratio (LTV) is one of common formula used by lenders to choose equity. Brand new LTV ratio try determined by splitting the loan count because of the the fresh property’s appraised really worth.

- To get a HELOC, you’ll want to pertain which have a loan provider and just have your house appraised to assess worthy of safely.

- Even in the event See Lenders does not bring HELOCs, you are permitted acquire between $thirty-five cash advance Cincinnati locations,000 so you’re able to $300,000 with a house collateral financing.

What exactly is home guarantee?

Household equity ‘s the difference between exacltly what the residence is really worth in the modern sector and how far you borrowed on your own mortgage. And come up with mortgage repayments and you can good market standards is build your guarantee.

Very, since you pay their mortgage or help with your family, the well worth expands, and therefore really does your residence collateral.

Even though some anyone play with their home guarantee because a form of discounts or disaster funds, of many exploit that it investment if you take aside a great HELOC or house collateral loan.

How much equity create I need getting a good HELOC?

Locate a great HELOC, you will need to apply that have a loan provider and also have your house appraised to assess worth securely. The lending company next uses a formula to determine just how much security you have of your home. Typically the most popular algorithm is the loan-to-worthy of ratio (LTV).

The LTV ratio ‘s the loan amount split by property’s appraised really worth. Such as for instance, when you have an excellent $100,000 home loan along with your residence is appraised at the $two hundred,000, your own LTV ratio might be fifty%. Lenders essentially approve HELOCs in the event your LTV proportion is just about 80% otherwise less. Very, making use of the example more than, owing over $160,000 on your financial make it difficult so you’re able to qualify for a great HELOC.

However, all of the lender provides more standards, therefore it is always best to discuss with numerous lenders before you apply for a financial loan.

Family guarantee financing compared to. HELOC

House guarantee funds and HELOCs was both a way to borrow on the value of your residence, however, there are several critical differences between both. Having a house security financing, you obtain a lump sum payment of money and come up with fixed month-to-month repayments more a flat several months.

HELOCs performs in a different way – you’re acknowledged for a line of credit to draw into the as needed, up to a particular limitation. Because of this you pay notice toward number of money you eliminate from your own borrowable maximum, and you’ve got a great deal more liberty when it comes to when and just how you will be making money.

Household collateral funds typically have straight down rates than other financing choice like unsecured loans or playing cards, making them useful for significant costs instance home fixes or home improvements. But not, because they are secured by your domestic, defaulting into the a property security mortgage could cause foreclosures.

Simple tips to be eligible for a property security mortgage or HELOC

Qualifying to own a house collateral mortgage otherwise HELOC can appear overwhelming, but it need not be. Of the knowing the concepts regarding exactly how such loans really works, being aware what you need to qualify, and having sufficient guarantee, you can begin protecting money you desire for your upcoming investment.

Credit rating

Your credit score performs a crucial role in your qualification having a home guarantee loan otherwise HELOC. Generally, large credit scores make you a much better risk of taking approved.

Good credit may also help lower the interest on the one loan you take aside. In the event the credit rating actually where it needs to be, start with examining your credit report getting errors and you will ensuring that your instalments was advanced.

Earnings

Lenders need to make yes you really can afford brand new money relevant to your financing, so they really check your total earnings or other sources like due to the fact financial investments, leasing assets income, and you may old age funds.

Debt-to-earnings (DTI) ratio

DTI ratio makes reference to just how much of the overall income goes on the paying established loans monthly (together with your most recent home loan). Loan providers usually favor individuals with down obligations-to-income rates since this may suggest that you’ll have less issue and work out money on your own the new financing along with latest obligations. A great guideline is when your debt-to-income ratio is higher than 43%, it could be difficult to obtain acceptance off loan providers.

Such, if the complete month-to-month obligations soon add up to $2,000, however you create $3,000 four weeks gross income, your DTI ratio is 66% ($2,000 divided by the $step 3,000). This could set you prone to becoming declined to have a beneficial HELOC.

Loan-to-really worth ratio

The brand new LTV ratio considers the value of your property and you may measures up it having how much cash you are inquiring to acquire in the lender.

The lower it ratio is, the greater your opportunity of getting acknowledged as it can show that there surely is sufficient equity available should things not work right with the payment plan. Lenders normally envision applications with LTV ratios up to 90%.