- Em que podemos lhe ajudar?

- 21 2240-0232

- 21 99624-5304

- [email protected]

Next Home loan Versus. Refinance: What’s the Huge difference?

Cazinouri Online Germania 2024 pentru jucători Români

Outubro 4, 2024Live casino România top operatori de jocuri live în 2024

Outubro 4, 2024Next Home loan Versus. Refinance: What’s the Huge difference?

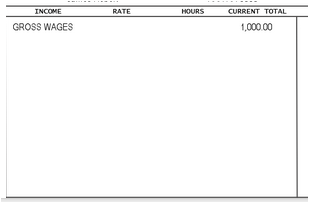

To be approved having an extra financial, you will likely need a credit score of at least 620, even in the event personal bank standards tends to be large. Including, understand that higher score associate which have top prices. You will additionally most likely have to have a financial obligation-to-money ratio (DTI) that is lower than 43%.

An additional financial differs from a mortgage re-finance. When you take away an extra mortgage, you place an entirely the fresh new homeloan payment on the range of monthly obligations.

You need to shell out your own new home loan plus some other percentage into the 2nd lender. Additionally, once you re-finance, you pay out of the completely new loan and you may change it having a beneficial new-set off financing words out of your original bank. You simply create you to percentage a month having an effective refinance.

In case the lender refinances home financing, they know that there can be already a lien into the possessions, which they can take since the equity or even pay your financing. Loan providers taking the second home loan do not have the same make certain.

In case there are a foreclosure, your second lender simply gets reduced following first bank obtains their cash back. Thus if you fall far behind on your original mortgage repayments, another bank will most likely not get anything more. You may have to shell out a higher interest on the a great second financial than simply an effective refinance given that 2nd home loan company are taking up increased chance.

This prospects of a lot people to decide a cash-out refinance more than one minute mortgage. Cash-aside refinances leave you an individual lump sum payment of guarantee off a loan provider in exchange for another type of, high prominent. Home loan rates of money-out refinances are nearly always less than 2nd financial cost.

Discover more about the difference between one minute home loan and an effective re-finance by doing then research to ascertain which is most effective for your requirements.

Types of 2nd Mortgage loans

There are two biggest brand of second mortgages you could choose from: property security financing or property equity personal line of credit (HELOC).

Domestic Collateral Mortgage

Property equity mortgage enables you to need a swelling-contribution payment out of your guarantee. When taking away property equity loan, the second home loan merchant will provide you with a share of one’s guarantee within the bucks.

In exchange, the lending cash loan usa North Johns Alabama company will get another lien on your property. You have to pay the mortgage back into monthly obligations that have interest, such as your amazing home loan. Really family equity mortgage terminology include 5 to help you thirty years, which means you pay him or her back more than one to put date physique.

Family Guarantee Line of credit

Domestic collateral personal lines of credit, otherwise HELOCs, dont leave you profit a single lump sum payment. As an alternative, it works similar to a credit card. Your bank approves you getting a personal line of credit predicated on the amount of guarantee you really have of your home. After that, you could borrow against the credit the lender extends to you.

You are able to discovered unique checks otherwise a credit card and then make orders. Such as for example a charge card, HELOCs explore a rotating equilibrium. This feature ensures that you need the money in your credit line multiple times if you repay it.

Such, in case the financial approves your getting an effective $ten,000 HELOC, spent $5,100 and pay it off. Next, you need an entire $ten,one hundred thousand once more down the road.

HELOCs are merely valid getting a predetermined period of time entitled good draw several months. You should make minimum monthly premiums through your mark months given that you are doing on a credit card.

When your mark period ends up, you ought to pay off the complete equilibrium left on your own financing. Your bank may need you to spend in one lump sum or make payments during a period of go out. If you’re unable to pay back everything you lent after brand new payment months, your own financial can also be seize your home.