- Em que podemos lhe ajudar?

- 21 2240-0232

- 21 99624-5304

- [email protected]

Regarding what a loan provider talks about to determine rates of interest, elements that produce a significant difference were:

Los más grandes casinos online sobre Colombia sobre 2024

Novembro 5, 2024Tragamonedas Gratuito Divine Fortune: Viaje an una Vieja Grecia con manga larga Desmesurados Premios

Novembro 5, 2024Regarding what a loan provider talks about to determine rates of interest, elements that produce a significant difference were:

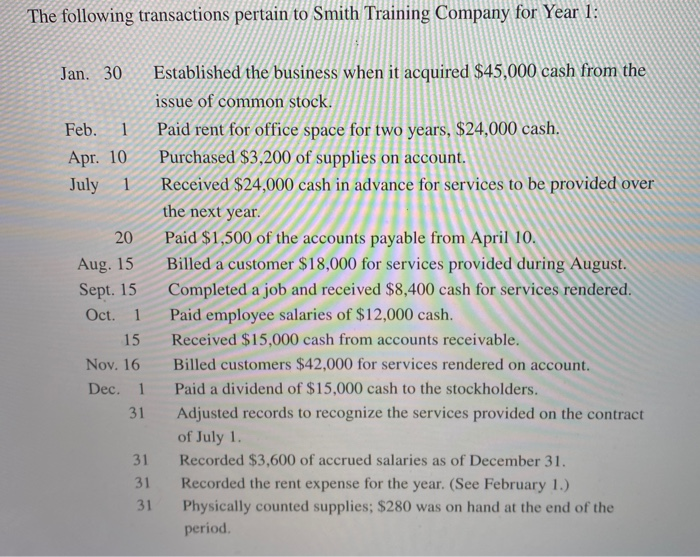

Also an obviously brief difference in rates have a good extreme impact on simply how much you find yourself spending since the desire over the course of the loan label. The information you to definitely observe comes from myFICO, reflecting mortgage pricing by https://paydayloanalabama.com/pleasant-grove/ the credit rating and you can demonstrating just how the monthly repayments are very different if you get an effective $two hundred,000 29-season repaired-speed mortgage. The brand new amounts imply national averages. The mortgage pricing work at the time of .

The difference from inside the monthly premiums involving the most useful and you will base tiers really stands at the $218. During the period of thirty years, this may add up to more than $78,000.

Other factors That affect Home loan Prices

When you find yourself your creditworthiness takes on a crucial role on the interest rate that relates to your own financial, loan providers take a look at additional factors also. Besides, mortgage rates remain changing in accordance with the Fed’s financial policy, monetary increases, and you will rising prices.

- Location of the domestic.A report put out from the Government Set aside Financial out-of Dallas suggests one to venue performs a crucial role from inside the home loan costs, and this have a tendency to may include that town to another location. So it, by-the-way, is also the truth having rural components.

- Loan amount and you can cost of the home. For many who need a really brief or large loan amount, your ount you ought to borrow is basically the essential difference between the new home’s selling price therefore the downpayment number.

- Deposit. Normally, and work out a massive down payment comes with less rate of interest. The reason being your financial usually view you because the lowest-risk borrower, considering the equity you hold of your house. If you are comfy and make an advance payment of 20% or higher, doing so might work well to you from the a lot of time-identity savings views.

- Financing identity. Less loan terms tend to incorporate all the way down interest rates when versus prolonged words. not, needed that you generate huge monthly payments.

- Debtto-income (DTI) ratio. The DTI ratio suggests how much of your money you have made per month would go to the debt costs. Financial team want which matter are 43% otherwise down. Lenders examine low DTI ratios having choose, which may then result in a lower life expectancy interest.

- The lender you select. Interest levels age type of home loan with respect to the bank you see . Financial team charges more rates considering affairs particularly overhead can cost you, sense, profile, and income. Be aware that the lending company that provides a reduced costs isn’t the greatest since you also need to account for customer support and you can autonomy with regards to.

Simple tips to Improve your Credit rating?

If for example the credit score isnt sufficient, imagine improving it before applying getting home financing. This assists open up a great deal more channels and you may in addition to make the most of a reduced interest rate. Adopting the a number of simple steps is also place you on the right highway.

Opinion Your own Credit file

Begin by taking a duplicate of the credit file in the ideal around three credit bureaus Experian, Equifax, and you may TransUnion. Undergo for each cautiously to determine as to why your credit rating was reduced. You’ll find instances when credit history bring incorrect advice, very be looking of these. If you discover any mistake, get in touch with the financing agency and ask for they to really make the expected correction.

Spend Your own Bills timely

Among the different facets which affect your credit rating , commission records requires the top room, bookkeeping having thirty-five%. Because of the feeling this factor has actually, it’s vital that you pay all your costs punctually. You may also track the debts through some type regarding filing system otherwise form notice. Immediately using their bills of the hooking up these to your finances is the best. You are able to think using your own expense having fun with a credit card to make advantages and alter your credit score, however, tread so it street as long as you are sure it will be possible to pay off your mastercard equilibrium in full each month.