- Em que podemos lhe ajudar?

- 21 2240-0232

- 21 99624-5304

- [email protected]

step three. You can aquire far more to suit your money

Luck position insect world hd Local slotocash casino login bonus codes casino British

Dezembro 2, 2024Best No deposit Bonus Also offers play zentaurus & Campaigns, Play for Free

Dezembro 2, 2024step three. You can aquire far more to suit your money

To find property means a significant amount of bucks. As well as a downpayment, you will also you would like money to own settlement costs, and you will lenders will require you to has actually bucks supplies to exhibit you could potentially manage your costs. You also need to consider a crisis fund, currency to have fixes and you can repairs and you may swinging expenses.

When you yourself have enough money stored regarding the bank to pay for those people can cost you, you’re in sound condition and will most likely afford to purchase good family.

According to experts at the Fl Atlantic University, in a few urban area section – together with New york, Boston and you can Chi town – to get and you may creating collateral are a better way to build enough time-label riches than simply renting.

Aside from the possibility of strengthening guarantee – that is definitely an excellent grounds to consider – you can also have more for the currency by purchasing as an alternative off leasing.

Depending on the markets close by, you’re capable see property with square footage – each other indoors and you will aside – as well as most readily useful accessories and better places for the same payment per month because a smaller sized or less-current rental property.

4. Need more space in the home to own relatives, work

- You might be thinking of broadening all your family members: If you intend into with people, you might need a larger household so you’re able to enjoys a garden center.

- You prefer room having dogs: You could follow a pet, however your property owner does not enable them. Or you may wish a house having a garden so your canine possess space to understand more about.

- You works remotely: With quite a few someone transitioning so you’re able to remote works, you will be wanting a property for lots more space for a loyal place of work.

If you end up with property with increased room than you would like, you can acquire a roommate otherwise rent out bare room to help you secure more funds to put on the student loans or any other monetary requirements.

5. You have got the lowest-attract student loan

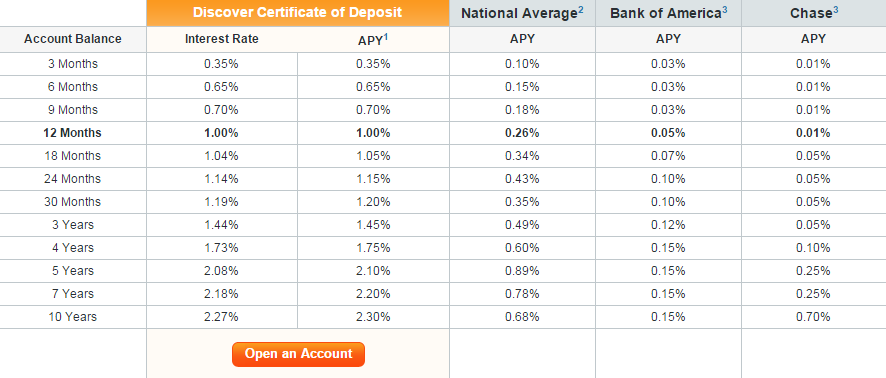

Compared to other forms regarding financial obligation, for example credit cards and you will automobile financing, student loans normally have lower rates of interest and more beneficial payment alternatives. Before, education loan rates of interest was indeed as low as dos.75% to own government money. Together with, their student loans will get entitle that a valuable income tax deduction – towards education loan notice income tax deduction, you ount of great interest your paid on their fund, any kind of are quicker.

However wish to pay back $ten,000 when you look at the credit card debt as quickly as possible because of how fast interest can be accrue, $ten,000 from inside the college loans is typically better to pay off. Investing precisely the minimal so you’re able to take back funds to find a great domestic is sensible.

Student personal debt versus. homeownership: How exactly to do each other

Choosing whether to pay back student loans or buy a property can be difficult. Every person’s state differs, there is persuasive arguments both for selection. When choosing what’s right for you, consider carefully your newest cash, priorities and upcoming requires.

But never let your finance dissuade you against to invest in property. You might be capable buy a house and you may lower your college loans at the same time with our methods:

- Follow your debt avalanche method to attack large-interest personal debt basic.

- Imagine student loan refinancing to lessen the studies debt’s interest rates, when you yourself have good credit otherwise a helpful cosigner. (Stay away from refinancing federal fund, however.)

- Unlock independent savings membership. Once you secure additional money, split up it and you may personal loans for bad credit Alaska put particular with the a merchant account designated for a down payment. Deposit the others for the another type of make up the emergency finance or almost every other specifications.