- Em que podemos lhe ajudar?

- 21 2240-0232

- 21 99624-5304

- [email protected]

USDA Funds into the Nyc & Pennsylvania: Eligibility, Prices & Standards 2024

Tragamonedas Mega Moolah Megaways: Sus particulares y no ha transpirado demo de balde

Outubro 29, 2024Casinos Online en Perú referente a 2024

Outubro 29, 2024USDA Funds into the Nyc & Pennsylvania: Eligibility, Prices & Standards 2024

If you are searching to purchase a property in a rural urban area, and can’t get a vintage mortgage, Artist Home loan try happy to give a great USDA financing within the The York & Pennsylvania, great no-down-fee system not limited so you can very first time homeowners which have reduced so you can reasonable income, backed because of the USDA (Us Agency away from Agriculture).

The newest USDA Rural Innovation Home loan System when you look at the Nyc & Pennsylvania lets borrowers to finance to 100% of the property value our home with no advance payment is needed.

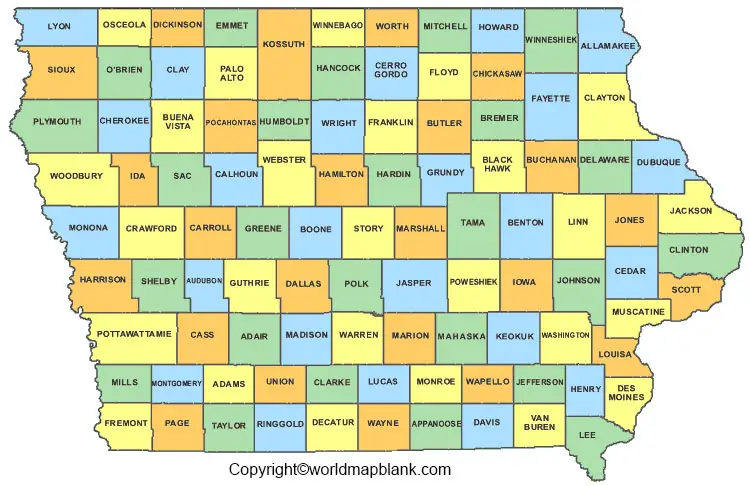

To become eligible for this new USDA financing system from inside the New york & Pennsylvania the home have to be a domestic family, eligible condominium or planned device improvements (PUD), situated in an outlying and suburban town, designated by U.S. Service regarding Farming.

For more information on the Outlying Creativity Secured Construction Mortgage System eligibility, cost & conditions inside 2024 complete means in this post, telephone call our experienced mortgage manager at (833) 844-0141 otherwise prequalify getting a home loan today.

Do you know the Eligibility Criteria to own a beneficial USDA loan into the Brand new York & Pennsylvania?

Brand new USDA loan insures mortgages produced by banking institutions less than this choice. Just as the Va loan, there was an upfront be sure commission that’s normally 2% but this program and carries an annual payment of 0.4%. Its similar to financial insurance but termed as a hope fee.

Into the , All of us Institution away from Agriculture set the absolute minimum credit rating to have this option within 640. Before the transform, it may be acknowledged that have many 620. Just be sure to completely file your revenue.

Within Artist, we understand that a “you to dimensions matches all’ method of domestic credit just doesn’t work. We actually implement real men and women to build financing choices and you may customize money for the financial need. You can expect fixed and you may changeable price capital within competitive cost and you can versatile words.

Does my personal Urban area Qualify for a ny & PA USDA financing?

When you are located in an area designated because of the USDA all over New york and you can Pennsylvania you will be eligible for it mortgage. Certainly, most other being qualified facets may come into gamble such as credit and you can income but it is an excellent mortgage choice for individuals who fit the product.

Nevertheless the book facet of Artisan is that we could top qualify your for 1 in our mortgage circumstances centered on our versatile certification techniques. We’ve designed loan apps and this include the life course points you to borrowers normally fall under. Looking at this amazing site is an excellent 1st step from payday loans Excel inside the your mortgage academic processes.

People from the Artist Financial is really knowledgeable and you can friendly. We anticipate doing business and would highly recommend my pals and you will family members so you’re able to Artist for their mortgages!

Questions relating to USDA loans into the Ny and Pennsylvania?

Artisan Mortgage’s competitive prices may potentially end in high coupons having you along side length of the loan. Whether you’re searching for a 30-seasons repaired-speed mortgage otherwise good 5-12 months adjustable-rates financial, we might manage to make it easier to. All of our objective is to understand your financial need and you can needs, and you will functions directly with you so you’re able to make the most of your personal solutions. Applying is easy, and you may get your address fast. The knowledgeable and you can experienced loan officials appreciate working out for you through the purchase procedure. Without having all the information in hand – don’t be concerned, simply get into everything know. The remainder of everything is collected during the an afterwards go out.

Without having for you personally to out in once have fun with new short means on right to request a customized Financial Offer, otherwise begin brand new prequalification process on line.

For more information on USDA loan earnings limitations, cost, eligibility within the New york & Pennsylvania 2024 along with Much time Area, Nassau and you can Suffolk County, New york having lower income, bad credit very first time homebuyers, and you can consumers that simply cannot score a classic home loan, e mail us today at the (833) 844-0141 or please go to the united states Agencies regarding Agriculture (USDA) certified web site.