- Em que podemos lhe ajudar?

- 21 2240-0232

- 21 99624-5304

- [email protected]

USDA Qualifications Chart: Be sure a speech or Place

What is actually Expected to Get approved getting a mobile Home loan?

Outubro 10, 2024Interest in mortgage refinancing has been increasing

Outubro 10, 2024USDA Qualifications Chart: Be sure a speech or Place

This affiliate-amicable map allows you to rapidly know if your own wanted venue qualifies having a USDA Loan, beginning doors so you’re able to affordable capital choices and a satisfying lifetime when you look at the your perfect society.

Strategies for the DSLD Mortgage USDA Financial support Qualification Chart

Having fun with our very own chart is not difficult! Just type in the fresh target of the home you located, therefore the map usually quickly assist you in the event it drops inside a great USDA-qualified city. Elements emphasized in yellow try ineligible, when you find yourself section in place of red shading qualify to own USDA Fund. Its so easy to get going on your own path to homeownership.

What is an excellent USDA Financing?

A good USDA Financing, backed by the united states Service from Agriculture, are a national-covered mortgage designed particularly for lowest- to moderate-income homebuyers in the qualified rural components. USDA Money bring several pros that make homeownership more obtainable, including:

- No deposit needs : USDA Financing generally speaking don’t need a down payment, reducing the fresh financial burden of purchasing a property.

- Low interest : USDA Money usually have competitive interest rates, and then make monthly premiums less expensive.

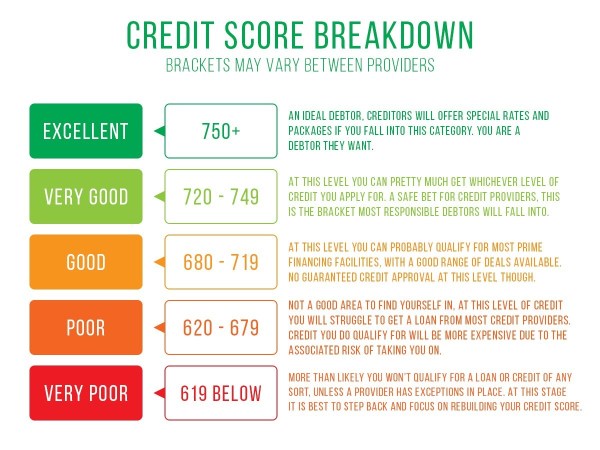

- Flexible credit standards : USDA Financing much more lenient which have credit scores versus Traditional Fund, opening doorways so you can a larger range of people.

- Quicker financial insurance coverage: USDA Money possess down financial insurance fees than other financing models.

If you’d like to do so much more browse before you take the next step towards the American Fantasy, here are a few our very own publication, What exactly is Good USDA Mortgage?

How the USDA Eligible Possessions Chart Works

To help you be eligible for good USDA Mortgage, the home you are interested in should be located in an effective USDA-designated eligible town, because revealed into all of our map.

While USDA Money are normally regarding the rural components, the newest eligible elements was wider than you may envision! Of numerous short towns and residential district organizations slide inside USDA’s meaning from rural. Fool around with all of our interactive USDA Qualifications Map to see a number of out-of locations that might be ideal for the next home.

- Primary residence : The property can be used since your number 1 household, maybe not a secondary household or money spent.

- Smaller dimensions : Centered on USDA direction, a house is considered smaller in dimensions in case it is less than dos,000 square feet. Yet not, you can find conditions, so it is worth getting in touch with that loan Manager having expertise in USDA Fund.

USDA Mortgage Eligibility Conditions

Beyond the property’s venue and you will condition, additionally must meet particular borrower qualifications criteria in order to be considered having a USDA Financing. These types of standards include:

- Money limits : cash loans in Meridianville Your revenue have to fall into the USDA’s income limitations to suit your area.

- Creditworthiness : While there is no minimum credit score specifications , a great credit rating normally improve your probability of recognition and you can safer better financing terms and conditions.

- Debt-to-earnings proportion : The debt-to-income proportion is have indicated what you can do to settle the mortgage.

If you’ve experimented with new USDA qualifications property map but they are nevertheless unsure for many who meet most of the qualification standards, reach out to DSLD Mortgage’s experienced Loan Officers . They can talk you by using the newest USDA Qualifications Map and you will next offer designed information considering the money you owe and you will homebuying desires.

Talk about The USDA Loan Choice having DSLD Home loan

DSLD Financial will be your top partner from inside the dealing with the latest USDA Mortgage processes. Our experienced Mortgage Officers are dedicated to working out for you get the ideal financial support services for your needs.

Whether you are using the USDA Mortgage city map to recognize USDA Loan-qualified section or perhaps researching the latest USDA financing chart standing, we are here to guide you.

We shall help you determine if a USDA Financing is useful getting both you and show you through the means of securing a great USDA Mortgage for the dream home. Our team may also be helpful you are sure that brand new nuances of the this new form of the fresh new USDA Qualification Map, making sure you’ve got the really right up-to-date suggestions.

Your USDA Qualification Location: Start Your Excursion Today!

If you think you’ve located a dream home that meets the fresh USDA Mortgage Qualification Map standards otherwise is actually enthusiastic about an excellent high place on the USDA Loan qualification chart that sparks your notice, please touch base. We can help you comprehend the USDA Qualifications Chart in detail and you will make suggestions to your seeking your dream USDA-qualified assets.

Happy to talk about the possibilities of an alternate types of lifestyle? Do the initial step with the fantasy domestic because of the asking for a 100 % free visit having an effective DSLD Mortgage Officer . We are going to make it easier to dictate their eligibility, address questions you really have, and you will guide you from pre-degree techniques. Do not miss out on the ability to build your homeownership ambitions a real possibility!