- Em que podemos lhe ajudar?

- 21 2240-0232

- 21 99624-5304

- [email protected]

What does This mean to possess Utah Homebuyers Rather than An advance payment?

ecoPayz Kasino Die besten Casinos qua ecoPayz Einzahlung

Dezembro 15, 2024Some Successful Advice About BBW to enhance Their Own Sex Life

Dezembro 15, 2024What does This mean to possess Utah Homebuyers Rather than An advance payment?

Downsides of a no-Off Mortgage:

- Provider you are going to favor another render If you make an offer towards the a house that have a beneficial pre-recognition to possess a no-down home loan if you’re a separate visitors can make a deal filled with 20% down, owner will dsicover one other buyer’s provide more attractive due to the fact they could believe they are less likely to encounter headaches during your order process.

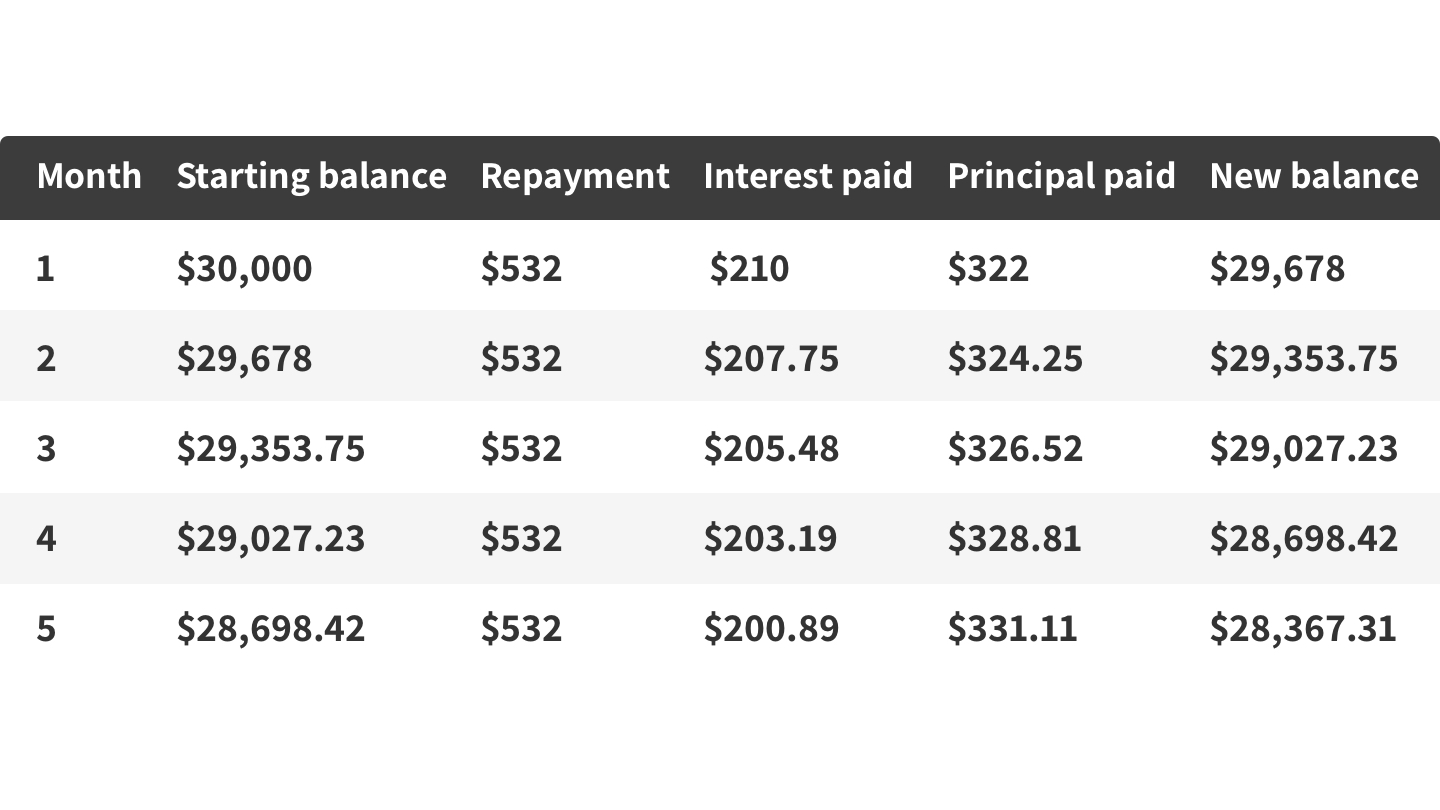

- Higher interest levels No-down mortgages generally have higher interest rates and make right up into the decreased an advance payment. Increased interest rate means that your instalments is huge, and you will probably finish expenses even more along side longevity of the borrowed funds.

- Which have zero equity If you buy a house instead of and work out an advance payment, you might not have guarantee in your home. This really is difficulty for many who feel an urgent situation just like the you will not be able to availability your house’s equity to fund unexpected costs.

- Private financial insurance coverage (PMI) If you buy a property that have no off, you will need to carry personal home loan insurance unless you has actually a good at least 20% security of your property. When you’re carrying out from the no security, this could just take decades. PMI try put into your own mortgage payments, and certainly will significantly enhance their amounts.

Important Expertise Of Recent Construction Degree

We strive to help our very own consumers make purchasing decisions that are tailored on the book factors as they are according to goal investigation. This will help to be sure our very own customers are fully told and understand its selection ahead of it apply for mortgage loans.

To aid, we’ve got reviewed analysis from the after the a couple of studies to add your with many details about housing affordability no-off mortgage loans:

Crucial Findings One to Concern Home buyers

Each other knowledge focus on that property prices are for the a persistent go up. According to the Harvard research, home rate love all over the country touched 20.6% in the , a significant dive out of previous age. This raise is not an isolated event, as 67 out of the finest 100 property segments also have knowledgeable list-high prefer costs.

It is not precisely the broadening cost of land; payday loans Graysville no job this is the traps they angle to own possible people. The newest Harvard data mentions you to definitely having a median-charged domestic in the , the newest down payment, typically 7.0% of your own transformation price, do total $twenty-seven,400. Now, why don’t we contextualize it: 92% regarding renters keeps median deals regarding merely $1,five hundred. The brand new mathematics is simple; antique downpayments are only out of reach for many.

Even yet in the face regarding financial difficulties, new ambition to have homeownership has not changed. The fresh new Metropolitan Institute’s investigation provides persuasive evidence, detailing one to homeownership prices those types of significantly less than thirty five flower from 36.5% inside the 1994 so you can 40.2% from inside the 2021. So it self-confident trajectory certainly younger customers is additionally substantiated by Harvard declaration. The info will make it pretty obvious: home ownership remains a beloved purpose having plenty of people.

To start with, Utah owners should comprehend that not that have a substantial down-payment does not prohibit all of them of homeownership. With ninety-five% from renters with average offers out-of simply $step one,five hundred, you are certainly not alone contained in this predicament. The main should be to explore solution home loan choice and applications that cater to those individuals in the place of a timeless down payment. Apps such USDA funds, Va fund, and you can particular FHA financing makes homeownership you can easily with little in order to zero down payment.

When you’re across the country styles render a useful backdrop, Utah keeps book casing ics. Utah possess seen an increase in its society and you may a flourishing tech community, leading to increased demand for belongings. This could translate so you’re able to steeper rates, but it addittionally setting you will find a stronger push for lots more inclusive financial support options to focus on the fresh country’s varied people.