- Em que podemos lhe ajudar?

- 21 2240-0232

- 21 99624-5304

- [email protected]

What is actually a great USDA Financing and how Perform I Implement?

Gamble Local casino On the web Greeting Offer up so you can R2000

Outubro 2, 2024Best On-line casino Added bonus Also provides 2024 Allege Their 100 percent free Bonuses

Outubro 2, 2024What is actually a great USDA Financing and how Perform I Implement?

Regarding the You.S., the populace stays in urban areas. But also for many people, living in an outlying otherwise country city is more appealing. If you need outlying living more than urban area lives, an application about United states Department out of Agriculture (USDA) helps you purchase property. Annually, the new USDA uses its Outlying Invention system to expend on $20 mil in aiding family members over the United states purchase and improve their home. The program was designed to raise outlying economic climates and you may improve high quality regarding life.

Below we mapped out an introduction to brand new USDA Rural Development Protected Casing Loan System, describing how it works and if you are qualified to receive funds.

What’s a USDA Loan?

The latest USDA loan program falls under the newest department’s unmarried-nearest and dearest construction program. It aims to encourage the purchase of house during the outlying or suburban portion through mortgage loans more relaxing for consumers to obtainpared so you can old-fashioned fund or any other types of regulators-protected money, USDA finance have lower down commission criteria minimizing income criteria. The brand new fund have rigorous earnings and you may venue criteria.

USDA money belong to numerous groups, which includes only available to help you individuals towards lowest incomes. The new finance might be straight from the brand new USDA otherwise supplied by personal loan providers and you can guaranteed from the company. The new USDA’s Outlying Invention system also offers has to individuals just who should work on construction build systems.

Whilst purpose of the new USDA financing program should be to generate homeownership so much more available to a wider swath regarding buyers, there are specific standards somebody must see in advance of he’s eligible for this new financing. Brand new USDA’s software provides earnings limitations and regularly have credit rating conditions.

USDA financing are often labeled as Area 502 loans. The newest mortgages attempt to promote most-lower so you’re able to modest-earnings people which have entry to sanitary, decent and you may safe houses from inside the qualified parts.

Types of USDA Finance

This new USDA’s Solitary-Members of the family Casing system has several types of fund that are made right to consumers, along with has and you may fund designed to organizations which help lower-earnings someone purchase otherwise improve their land. The latest financing and you can features that will be area of the program tend to be:

step 1. Lead Financing

These types of mortgage loans are made to fit lower- so you’re able to very-low-income candidates. The money tolerance may vary of the area, with subsidies, interest levels can be as lowest due to the fact 1%. Direct funds are from the brand new USDA, maybe not of a private lender.

- Keeps a full time income below the lower income limit because of their town.

- Get into need of as well as sanitary property.

- Commit to reside in your house because their number 1 household.

- End up being legitimately in a position to take on a loan.

- Struggle to get a mortgage through-other means.

- End up being a beneficial You.S. resident or qualified non-resident.

- Be permitted to participate in government programs.

- Have the ability to repay the debt.

Our house a guy buys with a direct USDA loan need meet up with multiple requirements, also. Since 2021, it needs to be less than dos,100 sqft and ought to become located in a rural area with an inhabitants under thirty five,100000. The worth of our house needs to be below the fresh financing restriction towards the town. It cannot be studied for money-producing issues and cannot have an in-floor pool.

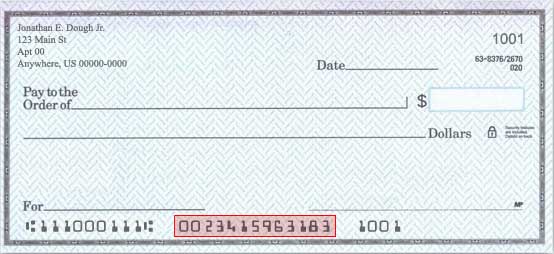

Consumers just who get percentage guidelines normally get rates since the reduced as step 1%. The new USDA lets individuals to rating lead money that have a hundred% financial support americash loans Edgewater, definition they do not have and also make a deposit. Whilst fees months is normally 33 years, there is a substitute for stretch they to help you 38 years established towards an effective borrower’s earnings qualification.